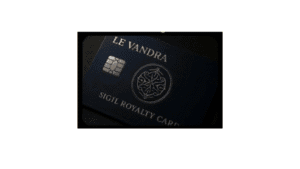

Le Vandra Sigil Card: A Debt-Free Digital Payment Solution

Introduction:

Managing money in today’s digital age is about more than just convenience it’s about safety, flexibility, and independence. For decades, traditional financial tools like credit cards have been linked with debts and hidden charges. These systems often leave users trapped in repayment cycles, adding unnecessary stress to their financial lives. Enter the Le Vandra Sigil Card, a modern solution designed to give people freedom from these financial burdens. This removes the implication of “interest-based credit” (important for halal content).

What is the Le Vandra Sigil Card?

The Le Vandra Sigil Card is a prepaid digital payment card created to simplify money management. Unlike conventional cards tied to borrowing or repayment, this card runs on a load-and-use system. You decide how much to add, and you can only spend that balance. This ensures financial independence by removing credit lines, debts, and surprise charges. It is especially appealing to students learning money management, freelancers seeking secure payments, travelers looking for safe global spending, and everyday users who value transparency.

Le vandra sigil card limit

The “Le Vandra Sigil Card” is an ultra-premium, highly exclusive product (likely issued by a luxury service provider like Insignia), not a standard retail credit card.

As with most cards in this exclusive tier, the credit limit is not public knowledge and is instead custom-determined for each affluent client.

It is generally assumed to have an extremely high or “no pre-set” spending limit based on the cardholder’s substantial financial capacity.

Le vandra sigil card is real or fake

The Le Vandra Sigil Card is real; it is an ultra-exclusive credit card offered by the luxury financial services group, Insignia. Due to its elite clientele, it is not a publicly accessible or widely known card, but it is a legitimate high-end product.

How the Le Vandra Sigil Card Works Without Loans

Traditional cards often operate on borrowed funds, creating repayment obligations. The Le Vandra Sigil Card works differently. Users load money onto the card and spend only that amount. Once the balance is finished, they can reload it. This approach eliminates the risk of debt entirely and provides a transparent, worry-free spending experience that keeps users fully in control.

Freedom from Debt and Extra Charges

One of the strongest appeals of the Le Vandra Sigil Card is its straightforward nature. Users never have to deal with loans, late payments, or extra charges. Instead, it works on a simple principle “use what you have.” Whether shopping online, booking travel, or paying for subscriptions, the card ensures a stress-free process without hidden traps. By removing the weight of loans, it empowers people to enjoy real financial freedom.

Who Can Use the Le Vandra Sigil Card?

The card is designed for inclusivity, making it suitable for almost anyone. Students can use it to practice financial discipline while managing allowances or scholarships. Freelancers and remote workers benefit from its global usability, allowing easy payments across borders. Travelers find it a safer alternative to cash when moving internationally. Everyday users also appreciate its convenience for shopping, dining, and entertainment without worrying about debt.

Key Features of the Le Vandra Sigil Card

The Le Vandra Sigil Card is packed with modern features that combine simplicity with security. Each transaction is protected with PIN codes, OTP authentication, and fraud monitoring, ensuring peace of mind even for international purchases. It is accepted globally across multiple platforms, making it ideal for both local use and travel. The card also integrates seamlessly with digital wallets, enabling mobile payments, quick top-ups, and peer-to-peer transfers all from a smartphone.

Application Process

Applying for the Le Vandra Sigil Card is quick and straightforward. Users simply visit the official portal or provider, complete a short application form, and verify their identity with basic documents. Once approved, they load funds onto the card and activate it through SMS, app, or web portal. From there, it is ready for immediate use. Avoiding mistakes like incorrect details or skipping verification ensures a smooth process.

| Category | Benefit Summary |

| Luxury Service | 24/7/365 Dedicated Personal Assistant (PA) for any required support. |

| Financial | Flexible spending limits, monthly billing cycle, worldwide acceptance (Visa Infinite). |

| Exclusivity | Access to “The Voice of Luxury” online shopping platform for rare goods. |

| Concierge | Award-winning Lifestyle Management Services (travel, event planning, etc.). |

Benefits of a Loan-Free Card System

The card promotes financial discipline by limiting spending to only the loaded balance, making it a natural budgeting tool. Real-time transaction alerts and balance updates allow users to track expenses and adjust habits easily. Most importantly, it provides access to financial services for people who may not qualify for traditional credit-based systems, ensuring inclusivity and fairness.

Potential Limitations

While the Le Vandra Sigil Card has many advantages, it does come with some limitations. Since it operates on a prepaid balance, it may not be practical for very large purchases without frequent reloading. Some providers may not offer the card in every country, and top-up options may be limited in certain regions. However, increasing integration with mobile wallets is helping to address these challenges.

Le Vandra Sigil Card vs. Alternatives

Compared to prepaid wallets, the Sigil Card provides both physical and digital flexibility, making it more versatile for daily spending. Unlike credit cards, which depend on borrowing and repayments, this card allows only prepaid usage, eliminating risks of debt and hidden charges. It strikes a perfect balance between security, convenience, and independence.

Best Practices for Managing Your Card

To get the most out of the Le Vandra Sigil Card, users should practice smart habits. Setting a monthly or weekly budget before loading funds helps avoid unnecessary overspending. Regularly checking transactions ensures alignment with financial goals and quick detection of suspicious activity. Keeping card details private and enabling two-factor authentication boosts protection against fraud.

User Experiences

Feedback from global users highlights the card’s effectiveness. Students appreciate the way it teaches responsibility, while freelancers find it useful for international work. Travelers enjoy the safety of carrying funds digitally instead of cash. The common theme across all reviews is peace of mind users feel more secure, more in control, and less stressed about money.

The Future of Loan-Free Digital Cards

As digital finance evolves, the Le Vandra Sigil Card is leading the shift toward debt-free systems. With e-commerce, subscriptions, and global payments becoming the norm, prepaid solutions like this card are gaining popularity. Future innovations may include AI-driven spending insights, biometric security, blockchain integration, and wider merchant acceptance worldwide.

Why the Le Vandra Sigil Card Stands Out

The card stands out for its simplicity, inclusivity, and transparency. It is secure, globally usable, and flexible enough to fit the needs of students, freelancers, travelers, and everyday shoppers. Most importantly, it gives people complete control of their finances without relying on borrowed money. That independence is what makes it truly unique.

Conclusion

The Le Vandra Sigil Card represents far more than just a convenient payment option; it symbolizes a new way of thinking about personal finance. For too long, traditional financial systems have encouraged reliance on borrowing, hidden fees, and repayment cycles that weigh heavily on individuals.

This card takes a completely different approach. It operates on a prepaid model that promotes discipline, clarity, and control, giving users the ability to spend only what they have. That simple concept brings with it something much greater: peace of mind.

For students, the card becomes a valuable tool for learning responsibility, teaching them how to manage allowances, scholarships, or part-time income without falling into financial traps. Freelancers and remote workers, especially those who operate across borders, benefit from its global usability and straightforward nature, making international payments easier and safer.

Travelers, too, find comfort in knowing they can carry funds digitally instead of handling large amounts of cash, minimizing risks while enjoying seamless spending abroad. And understand how prepaid cards differ from credit cards.

Everyday shoppers appreciate the card’s simplicity, allowing them to handle daily purchases without worrying about hidden charges or complex terms.

The true strength of the Le Vandra Sigil Card lies in its inclusivity and transparency. It does not discriminate based on financial background or credit history. Instead, it opens access to secure and modern financial services for a wide range of people who may have been excluded from traditional banking options.

Its security features, global usability, and digital wallet integration make it both a practical and forward-looking tool in today’s digital economy.

As digital finance continues to evolve, the Le Vandra Sigil Card is paving the way for a future where financial independence is no longer a privilege but a standard. By combining simplicity, safety, and freedom, it empowers individuals to take full control of their financial journey.

In many ways, this card is more than just a financial product it is a lifestyle choice, a symbol of independence, and a step toward a debt-free future.

Halal Disclaimer:

FinancialEage promotes halal and ethical entrepreneurship. All business and financial insights shared in this article are for educational purposes only. Readers are encouraged to consult qualified Islamic finance advisors to ensure their profit and funding methods comply with Shariah principles, avoiding interest (riba), unethical practices, or prohibited (haram) transactions.

Note: Reference Review by Abdul Ghani & Islamic Business Enthusiasts.

Use these to connect related content within your site and improve navigation and ranking:

Use these to add credibility and reference reliable Islamic finance resources:

FAQs

1. Can the Le Vandra Sigil Card be used worldwide?

Yes, the Le Vandra Sigil Card can be used both locally and internationally, depending on the provider’s network and coverage. One of the biggest advantages of this card is that it eliminates the stress of carrying physical cash while traveling. Whether you are shopping online from global stores, booking flights, or paying for hotel stays abroad, the card makes these transactions simple and safe.

Many providers partner with international payment systems, so the card is accepted in a wide range of countries. It also allows users to make online purchases in foreign currencies without the hidden charges that are often associated with traditional financial tools.

Before traveling, it’s wise to check with the provider about supported regions and reload methods in case you need extra funds while abroad. With its strong security features like PIN protection, OTP verification, and fraud monitoring, the card ensures peace of mind even when used far from home.

2. Do I need a bank account to apply?

No, you do not need a bank account to apply for the Le Vandra Sigil Card. This is one of the features that makes it so accessible to people from different financial backgrounds. Unlike traditional payment systems tied to banking requirements, the Sigil Card is designed to function independently.

Applicants simply need to provide basic identification and verification documents during the sign-up process.

Once approved, they can begin using the card by loading funds directly through approved outlets, apps, or online platforms. This independence from a bank account is especially useful for individuals who may not have access to conventional banking services or those who prefer not to tie their financial activities to a bank.

The card allows financial freedom without the extra obligations and paperwork associated with opening and maintaining a bank account.

This makes it inclusive, user-friendly, and an ideal option for people seeking straightforward digital payment solutions.

3. How do I reload funds onto the card?

Reloading funds onto the Le Vandra Sigil Card is simple and flexible, offering multiple convenient options to suit different lifestyles. Users can top up their balance through physical partner outlets, which are available in many regions.

Alternatively, online platforms and mobile apps linked with the provider allow quick digital reloading, making it possible to add funds instantly from the comfort of your home. Many providers also enable peer-to-peer transfers, meaning someone else can send funds directly to your card balance, which is particularly helpful for students receiving allowances or freelancers being paid for services.

To keep the process smooth, it’s recommended to monitor your balance regularly so that you reload in time before making essential payments or traveling abroad. Reloading is usually instant, and notifications confirm the amount added to the card. By giving users the flexibility to reload anytime and anywhere, the card ensures continuous, stress-free access to funds.

4. Is it suitable for online subscriptions?

Yes, the Le Vandra Sigil Card is highly suitable for online subscriptions, making it a convenient choice for today’s digital lifestyle. Whether you’re subscribing to streaming services, e-learning platforms, or professional software tools, the card works seamlessly across most online payment gateways. Because it functions on a prepaid basis, it gives you complete control over how much you spend each month.

For example, you can load only the amount needed for your monthly subscriptions, which prevents accidental overspending and ensures you stay within budget. This feature is especially helpful for families managing multiple subscriptions or students paying for online courses.

Many providers also support recurring payments, so you won’t need to reload manually every time a subscription is due, provided you maintain a sufficient balance. Its global usability means that even international platforms accept it, giving you flexibility to access services from around the world. With built-in security protections, your digital subscriptions are safe and easy to manage.

5. How secure is it for international transactions?

The Le Vandra Sigil Card is built with robust security features to protect users during both local and international transactions. It uses PIN codes, OTP (one-time password) verification, and advanced fraud monitoring systems that track unusual spending patterns. If any suspicious activity is detected, transactions can be blocked instantly, and the user is alerted in real time.

This layered protection ensures that even when using the card abroad, users remain safe from unauthorized access. Additionally, many providers integrate the card with mobile apps, allowing you to monitor transactions in real time and receive instant notifications after each purchase.

This transparency helps you stay in control no matter where you are. Unlike carrying physical cash, which can be lost or stolen without recovery, the Sigil Card offers a safer alternative, as lost cards can often be blocked and replaced quickly. Overall, it provides a secure and trustworthy way to manage money while traveling or making international payments.

i am a billionaire

Thank woow is good and i am giving motivation for money

Le vandra sigil card will make my life luxury but I not the lucky person in the 🌎 world

i you are lucky too but focus on ownself men keep doing

godd work